For B2B buyers and brand leaders planning future product lines, a deep understanding of the core inflatable fabric trends 2026 is the key to capitalizing on this growth.The inflatable boat market is poised for significant expansion, with industry reports projecting a compound annual growth rate (CAGR) of approximately 5.5% through 2032.[1][2][3]

This guide provides a strategic analysis of these developments, focusing on three pivotal areas: the ongoing performance battle between PVC and TPU, the structural revolution of drop-stitch technology, and the non-negotiable importance of safety compliance. Mastering these insights is essential for making smart, profitable procurement decisions in a rapidly evolving industry.

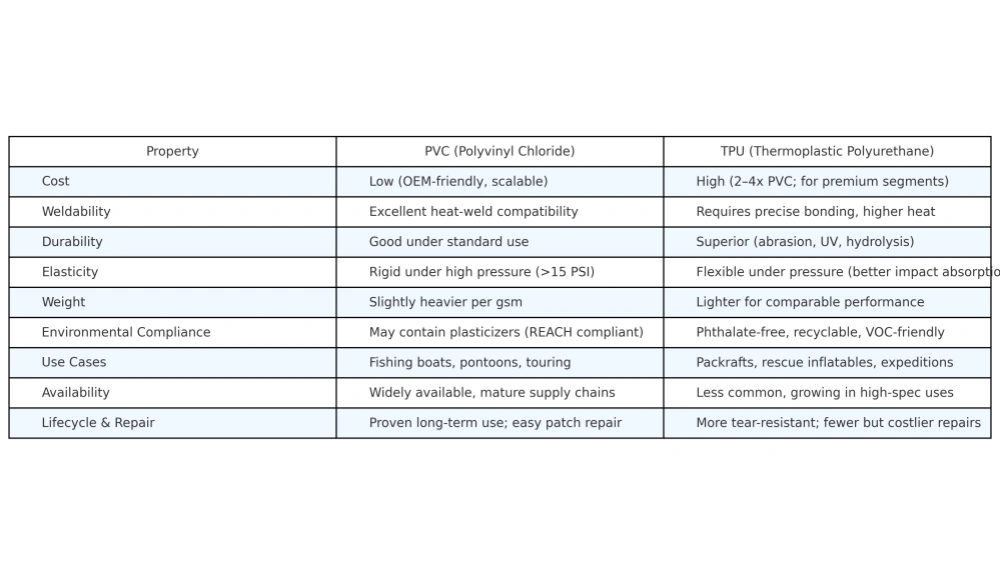

Inflatable Fabric Trends 2026: Trend #1 — PVC’s Dominance vs. TPU’s Rise

The choice between two primary materials is the most significant factor shaping the industry right now. On one side, Polyvinyl Chloride (PVC) continues its reign as the workhorse for large-volume OEM production. Market analyses, including reports from firms like UnivDatos, confirm that PVC-based fabrics hold the largest share of the global inflatable boat market due to an unmatched balance of cost, weldability, and proven field reliability.

However, a clear counter-trend is accelerating in premium segments, where Thermoplastic Polyurethane (TPU) is becoming a requirement, not just a feature. This creates a critical decision point for any brand positioning itself in the market.

Why PVC Maintains Its Role as the OEM Workhorse

- Best Value-to-Production Ratio

PVC-coated polyester fabrics (commonly ranging from 550–1500 gsm) provide a blend of lightness and strength. This shell welds cleanly on industrial heat welders without solvent use, offering faster production cycles and scalability compared to more complex TPU bonding processes. - Durability That Meets Expectations

TPU may offer higher resilience to UV, abrasion, and aging, but PVC remains a workhorse—handling saltwater, temperature cycles, and high-stress environments—at a reduced material and tooling cost. Analysts report TPU’s price premium ranges from two to four times typical PVC, restricting its use to premium or mission-critical applications. - Global Supply Chain Maturity

PVC woven fabric is globally available with established logistics for various GSM ratings, colour options, and strength reinforcements. B2B procurement teams trust its consistency—enabling designs from basic pontoon boats to utility craft with minimal spec upheaval.

Blue Rafty remains focused on PVC-based inflatable fabric systems—in line with mainstream OEM expectations for affordability, repeatability, and regulatory compliance. TPU options are offered selectively when clients specifically request high-performance materials.

Inflatable Fabric Trends 2026: Trend #2 — The Rise of High-Performance TPU

While PVC dominates the mass market, the strategic adoption of Thermoplastic Polyurethane (TPU) in premium and specialized sectors is one of the most significant inflatable fabric trends 2026. TPU serves as the high-performance counterpoint to PVC, appealing to brands whose identity is built on maximum durability, environmental responsibility, and cutting-edge technology.

Although its overall market share by volume is smaller than PVC’s, its growing importance in high-value applications makes understanding its benefits crucial for any forward-looking B2B buyer.

1.Lab-Proven Superiority in Wear and UV Resistance

This is where TPU’s higher cost finds its first justification. In standardized laboratory tests like the Taber Abrasion Test, [4] TPU consistently outperforms PVC, demonstrating a higher resistance to surface wear and friction. This translates directly to a longer product lifespan, especially in harsh saltwater or high-UV environments.

2. Enhanced Elasticity and Long-Term Durability

In most assessments, TPU delivers greater stretch and resilience than PVC. Aerospace-engineered TPU films retain elongation longer during cyclical loading, absorbing 6 to 30 PSI pressure changes without the crack initiation commonly observed in flexible PVC materials. Elasticity tests by tridentproducts.com emphasize that “TPU exceeds PVC when it comes to softness and elasticity” and specifically note TPU can stretch to twice the length of PVC before failure. [5]

3. A Cleaner Profile for Environmental Compliance

TPU’s chemical composition eliminates the need for phthalate plasticizers, immediately aligning it with strict global regulations like the EU’s REACH framework. For brands targeting sustainability-focused markets, TPU’s cleaner environmental profile and potential for recyclability offer a significant competitive advantage.

4. Lifecycle Value That Justifies the Higher Initial Investment

While the upfront material cost for TPU is approximately 2 to 4 times higher than for PVC, the decision should be viewed through the lens of total lifecycle value. For high-margin products, the investment is justified by lower warranty claims, a longer usable product life, and enhanced brand prestige. This strategic calculation is a core component of navigating the inflatable fabric trends 2026 for premium market positioning.

Inflatable Fabric Trends 2026: Trend #3 — Drop-Stitch Construction Transforms Rigidity

Beyond the choice of fabric, the most impactful of the inflatable fabric trends 2026 is how materials are constructed. Drop-stitch technology has moved from a niche feature to a mainstream expectation, fundamentally changing user perceptions of inflatable boat stability and performance.

The market momentum is undeniable. Industry analyses consistently project strong growth for advanced technical textiles, with drop-stitch materials being a key driver in the recreational watercraft sector.[7][8] This technology is revolutionary because it allows an inflatable product to achieve near-solid rigidity without the weight, storage, or assembly drawbacks of traditional hard floors.

The Core Innovation: High-Pressure Structural Integrity

The technology works by joining two layers of coated fabric with thousands of internal polyester threads. When inflated to high pressure (typically 6-15 PSI), these threads become taut, creating an incredibly strong and rigid panel. The result is a structure that can be walked on, loaded with gear, and provides the stable tracking of a hard-shell boat, yet it can be deflated and rolled up for transport.

The B2B Advantage: Superior Performance & Simplified Logistics

For OEM buyers and brand designers, adopting drop-stitch air-decks offers tangible competitive advantages over traditional plywood or aluminum floors:

- Enhanced User Experience: Air-decks absorb vibrations better, providing a more comfortable ride.

- Simplified Assembly: They eliminate the need for cumbersome and often heavy hard panels, making boat setup faster and easier for the end-user.

- Reduced Weight & Storage: A drop-stitch floor is significantly lighter and packs down to a fraction of the size of a rigid floor, a major selling point for customers with limited space.

Safety & Regulatory Compliance in inflatable fabric trends 2026

For brands sourcing globally, successfully navigating the inflatable fabric trends 2026 is only half the battle. The other, non-negotiable half is ensuring every product complies with key international safety directives. This is the foundation of market access, liability protection, and long-term brand reputation.

The cornerstone for market access in Europe is compliance with the Recreational Craft Directive 2013/53/EU (RCD). To prove a product meets the essential requirements of this directive, manufacturers rely on “harmonised standards” like EN ISO 6185.

Key Mandates from the ISO 6185:2024 Revision

The 2024 revision of this standard introduced critical updates that sophisticated B2B buyers must know. Compliance now requires documented proof of:

- Material & Temperature Resilience: Fabrics must maintain integrity and performance within a demanding operational temperature range of -20°C to +60°C.

- Structural Integrity Testing: Products must pass rigorous tests, including drop tests and seam strength analysis, to ensure durability.

- Clear Labeling & Traceability: Each boat must be clearly marked with maximum pressure, load capacity, and traceable batch numbers for the core materials.

OEM Checklist for Verifying Compliance

When evaluating a manufacturing partner, use this checklist to verify their commitment to these standards:

- [✔] Request Material Certificates: Ask for documentation verifying fabric type, GSM (grams per square meter), and origin.

- [✔] Verify Test Reports: Demand to see the technical file containing successful results for pressure, seam, and temperature tests.

- [✔] Check On-Product Labeling: Ensure the final product samples have clear, permanent markings for pressure and capacity as required by the standard.

- [✔] Confirm Chemical Compliance: For EU/US markets, require proof of compliance with chemical regulations like REACH or Prop 65.

Future Outlook: Smart Materials and Emerging Technologies

Looking beyond the immediate inflatable fabric trends 2026, forward-thinking brands are monitoring the next wave of material science innovations that promise to further enhance safety and durability.

Pressure-Sensing and Leak Detection

In high-stakes applications like rescue craft and unmanned platforms, in-fabric sensor integration is a growing trend. These systems allow for:

- Real-time monitoring of individual chamber pressure.

- Automated alerts for pressure drops, indicating slow leaks.

- Ensuring symmetric inflation for optimal performance.

While still a niche, high-cost feature, the underlying technology is becoming more accessible and is a key area to watch for high-end product differentiation.

Self-Healing Polymers & Bio-Based Coatings

On the horizon, research into self-healing polymers suggests a future where fabrics can autonomously seal small punctures. Inspired by biological mechanisms, these materials can repair micro-tears when triggered by mechanical stress. While widespread commercial adoption is still in the R&D phase pending cost and durability validation, it represents the next frontier in material resilience. Bio-based TPUs are also emerging as a long-term sustainable alternative.

FAQ — Answering Your Key B2B Questions

No. It’s a strategic trade-off. TPU offers superior abrasion resistance, flexibility, and eco-credentials, making it the best choice for high-performance, premium products. However, high-grade, reinforced PVC remains the industry standard for mass-market applications, offering an unbeatable balance of cost-effectiveness, durability, and manufacturing scalability.

For most brands, not yet. These are currently niche, emerging technologies best suited for high-end, specialized applications (e.g., military, unmanned rescue) where budgets are higher.

For mainstream 2026 production, the strategic focus should remain on mastering proven technologies: high-quality material sourcing (PVC/TPU), advanced construction (drop-stitch), and impeccable welding.

Define your target customer and brand position before you talk about materials. Are you targeting the high-volume recreational segment or a premium, performance-driven niche?

This single decision will dictate your entire material strategy, your cost structure, your compliance pathway, and ultimately, your choice of manufacturing partner.

Conclusion: Your Strategic Takeaways for 2026

The landscape of inflatable fabric trends 2026 is not about finding a single “best” material, but about making intelligent strategic choices. The market is clearly segmenting. Success for B2B brands and OEM buyers will no longer come from offering a one-size-fits-all product, but from precisely aligning material selection (the value of PVC vs. the performance of TPU), construction innovation (the expectation of drop-stitch), and safety compliance (the non-negotiable benchmark of ISO 6185) with a well-defined target market.

The most successful brands will be those who master this alignment. They will partner with manufacturers who not only execute flawlessly on today’s standards but also possess the expertise to guide them through the trends of tomorrow.

Turn These Trends Into Your Competitive Advantage

You’ve seen the trends. You understand the standards. Now, it’s time to build.

Partnering with the right OEM manufacturer is the single most important decision you’ll make. Blue Rafty doesn’t just build boats; we build brands. We combine decades of expertise in cost-effective, high-volume PVC manufacturing with the forward-looking capabilities to integrate next-generation materials and technologies.

Whether you’re scaling a proven design or launching a high-performance flagship, our team is ready to align our manufacturing power with your brand vision.

👉 Explore Our ODM & Enterprise Solutions in Detail

We hope this analysis provides a clear view of the road ahead. For more deep dives into manufacturing processes and material science, explore all our articles in the Tech & Industry Insights category.